Introduction

Insurance agents face a unique challenge: standing out in crowded inboxes while building trust around complex financial products. However, the right email marketing strategy can transform prospects into policyholders and one-time clients into lifelong customers.

In this guide, you’ll discover how to:

- Target clients by insurance type and lifecycle stage for highly relevant messaging

- Build educational content that positions you as an insurance expert, not just a salesperson

- Build automated customer journeys that nurture leads throughout their relationship with you

Let’s Go!

TL;DR

- Segment your audience by policy type, life stage, and behavior to deliver hyper-relevant insurance offers

- Personalize with policy-specific details and tailored recommendations based on client history

- Use single-column layouts with large tap-friendly buttons for a seamless mobile experience

- Remove inactive subscribers every 6-9 months to improve deliverability

- Include physical address and clear unsubscribe options to meet all legal requirements

- Create valuable content that educates clients about insurance needs and solutions

- A/B test specific subject lines with small audience segments before sending full campaigns

7 Email Marketing Strategies for Insurance Agents That Actually Convert

Email marketing for insurance agents is all about delivering value, building trust, and turning leads into loyal clients. These 7 strategies aren’t just tips—they’re proven tactics that will help you increase conversions and see real results.

1. Segment Your Audience for Higher Conversions

Generic emails get generic results. For insurance agents, effective segmentation is the foundation of email marketing success.

By dividing your email list into specific groups, you can deliver highly targeted messages that address each segment’s unique insurance needs and concerns. This relevance dramatically improves engagement and conversion rates.

Key segmentation approaches for insurance agents:

- By insurance type: Separate auto, home, life, and health insurance clients to send product-specific information

- By customer lifecycle stage: Create different messaging for prospects, new clients, and long-term policyholders

- By policy renewal dates: Group clients with upcoming renewals for timely reminder campaigns

- By demographic information: Tailor messages based on age, location, family status, or income level

- By past interactions: Target based on website visits, previous email engagement, or quote requests

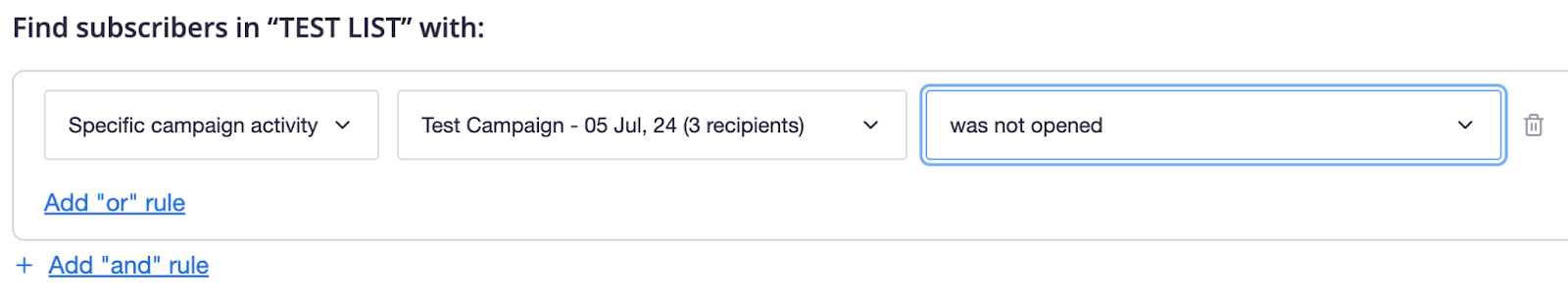

Our advanced segmentation capabilities allow insurance agents to create highly targeted segments based on any subscriber data point. You can also create custom segments, ensuring that every email you send is tailored to the specific needs and interests of your audience.

2. Make Personalization Non-Negotiable

Today’s customers expect highly personalized messages. Basic personalization like using a client’s name is just the starting point—true personalization means delivering relevant content based on their specific insurance needs and history.

Effective personalization strategies for insurance emails:

- Address specific policies: Reference the client’s actual policies by name and coverage details

- Acknowledge important dates: Mention policy anniversaries, renewal dates, or client birthdays

- Recommend relevant coverage: Suggest additional insurance policies based on life events or existing coverage

- Personalize subject lines: Include policy types or personal references to boost open rates

- Use behavior-based triggers: Send follow-up emails based on website activity or quote requests

Pro tip: When sending renewal reminder emails, include policy details and any potential changes or discounts available. This level of personalization shows attention to detail and increases renewal rates.

Our personalization features allow you to insert dynamic content blocks within a single email. This means you can show different content to different subscribers—based on their policy type, renewal date, or other custom fields—without needing to create multiple email versions. Plus, the Subscriber Preference Center lets your contacts update their preferences and personal details, ensuring your data stays accurate and your targeting stays sharp

3. Design Mobile-Responsive Emails

Emails that display poorly on mobile devices create friction in the customer journey and can significantly reduce conversion rates. Insurance agents who prioritize mobile-responsive design see higher engagement across all metrics.

Mobile optimization best practices:

- Use single-column layouts that adapt to smaller screens

- Keep subject lines under 40 characters to prevent truncation on mobile

- Make buttons large enough (at least 44×44 pixels) for easy tapping

- Test emails on multiple devices before sending to your list

- Optimize images to load quickly on mobile data connections

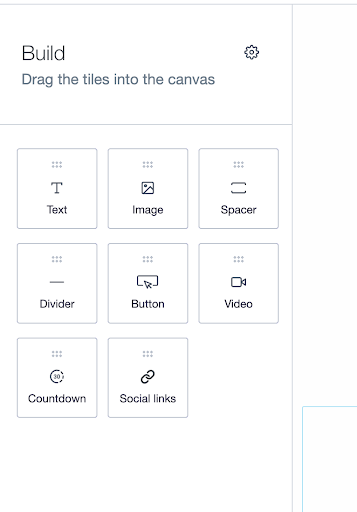

BTW, we make designing emails incredibly easy. You can either choose from our library of mobile-optimized templates or build your own using our intuitive drag-and-drop builder – no design expertise required!

4. Remove Inactive Subscribers

Email list hygiene directly impacts deliverability. When your emails consistently go to inactive subscribers, email providers may start sending your messages to spam folders—even for engaged subscribers.

For insurance agents, this means potential leads and renewal reminders might never reach their intended recipients.

How to handle inactive subscribers:

- Define “inactive” based on your business cycle (typically 3-6 months without opens)

- Create a re-engagement email marketing campaign with a compelling offer or update

- Remove subscribers who don’t respond to re-engagement efforts

- Regularly audit your list to maintain high engagement metrics

Example re-engagement subject lines:

- “We miss you, [Name]. Is your insurance coverage still adequate?”

- “Before we say goodbye—check your policy status”

- “Quick question about your insurance needs”

By maintaining a clean list, you’ll improve deliverability rates and get more accurate performance metrics, allowing you to focus resources on engaged prospects and current clients.

5. Stay Compliant with Regulations

Note: This content is provided for informational purposes only and does not constitute legal or regulatory advice. Campaign Monitor is not responsible for compliance with insurance carrier or jurisdiction-specific requirements. Please consult your legal team or compliance officer before implementing regulated communications.

Insurance is a highly regulated industry, and email marketing adds another layer of compliance requirements. Failing to follow regulations can result in hefty fines and damage to your reputation.

Key compliance considerations:

CAN-SPAM Act requirements:

- Include your physical address in every email

- Provide a clear unsubscribe option

- Honor opt-out requests within 10 business days

- Use honest subject lines that reflect email content

Insurance-specific compliance:

- Include required disclaimers based on your state regulations

- Ensure all product descriptions are accurate and approved

- Maintain records of client consent for marketing communications

- Follow carrier guidelines for representing their products

6. Always Provide Valuable Content

Insurance emails that focus solely on selling rarely perform well. Instead, successful insurance agents use email to educate clients, solve problems, and build trust—which naturally leads to more conversions.

Content ideas that provide genuine value:

- Educational resources: Explain insurance concepts in simple terms

- Risk management tips: Help clients protect their assets and reduce claims

- Life event guidance: Provide insurance advice for milestones like buying a home or having a child

- Claim process walkthroughs: Demystify what happens when filing a claim

- Industry updates: Explain how changes in regulations affect clients

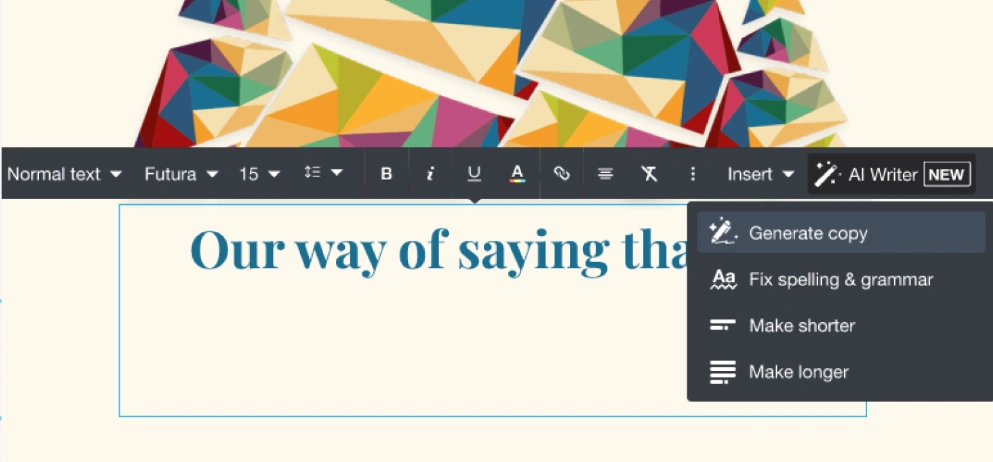

Hit a writer’s block? Our AI Writer Tool is here to help! Use generative AI to brainstorm ideas, repurpose content, and optimize your CTAs and messages. Plus, with personalized copy suggestions, you can adapt your content for specific audiences to drive more engagement.

7. Create Effective Subject Lines

Your subject line determines whether your carefully crafted email gets opened or ignored. For insurance agents, effective subject lines balance urgency and value without triggering spam filters.

Subject line best practices:

- Be specific: “Your auto policy expires in 14 days” works better than “Important insurance update”

- Create curiosity: “3 things most homeowners don’t know about flood coverage”

- Add personalization: Include the client’s name or policy type when relevant

- Use numbers: “5 ways to lower your premium this year”

- Keep it concise: Aim for 40-60 characters to ensure full visibility on mobile devices

Subject lines to avoid:

- ALL CAPS or excessive punctuation (triggers spam filters)

- Misleading statements about coverage or rates

- Vague urgency (“Act now!” without context)

Not sure which subject lines will grab attention? Our A/B Testing Engine lets you test subject lines, content blocks, and CTAs, so you can optimize your emails based on real user behavior. Plus, with Inbox & Spam Testing, you can preview your emails across devices and check for spam risks before sending them out!

Read Next

5 Best Sequences for Insurance Email Marketing

Now that we’ve covered the strategies, let’s explore the specific email campaigns every insurance agent should implement. These automated sequences deliver the right message at the right time without requiring constant manual work.

#1) Welcome Email Series

A strong welcome series sets the tone for your client relationship and drives early engagement with your insurance services.

| Timing | Content | |

|---|---|---|

| Welcome & Introduction | Immediately after signup | Insurance company introduction, advisor bio, contact information |

| Educational Resources | 2 days after signup | Insurance guides, FAQ links, video tutorials |

| Value Proposition | 5 days after signup | What makes your insurance business different, client testimonials |

| Next Steps | 7 days after signup | Invitation for consultation, policy review offer |

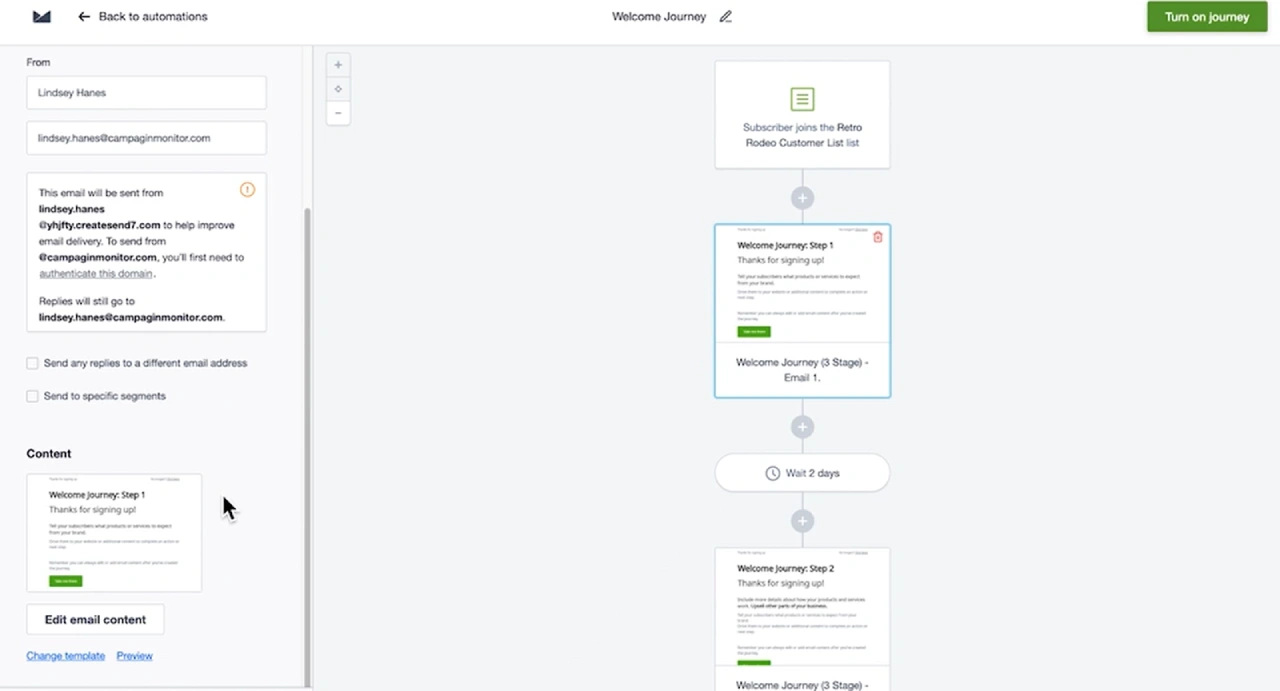

P.S. Our Visual Journey Builder automates not just the welcome sequence, but any multi-step email workflow triggered by customer actions—ensuring timely, relevant communication that drives engagement and sales

#2) Educational Newsletters

Source: ReallyGoodEmails (https://files.reallygoodemails.com/emails/how-much-does-a-dental-cleaning-cost-without-insurance.png)

Regular newsletters keep your agency top-of-mind and provide ongoing value to clients between policy renewals.

| Timing | Content | |

|---|---|---|

| Insurance Industry Updates | Monthly | Regulatory changes, market trends, new coverage options |

| Risk Management Tips | Quarterly | Seasonal safety advice, loss prevention strategies |

| Insurance 101 | Bi-monthly | Explanations of coverage types, insurance terminology |

| Client Success Stories | Quarterly | Case studies of how proper coverage helped clients |

With our dynamic content blocks, you can send personalized content based on subscriber interests. For example, you can send home maintenance tips to homeowners and safe driving tips to auto policyholders—all within the same campaign.

#3) Policy Renewal Campaigns

Timely, personalized renewal reminders are crucial for customer retention and prevent coverage gaps for your clients.

| Timing | Content | |

|---|---|---|

| Early Renewal Notice | 45 days before expiration | Policy details, renewal timeline, any premium changes |

| Policy Review Opportunity | 30 days before expiration | Offer to review coverage, potential discounts, life changes to consider |

| Urgent Renewal Reminder | 15 days before expiration | Clear call-to-action, consequences of non-renewal, easy renewal steps |

| Last Chance Reminder | 5 days before expiration | Direct renewal link/button, phone number for immediate assistance |

#4) Cross-Selling and Upselling Campaigns

Strategic cross-selling emails help clients get comprehensive coverage while increasing your revenue per customer.

| Timing | Content | |

|---|---|---|

| Related Policy Introduction | 30 days after the initial policy purchase | Complementary coverage options, bundle discounts |

| Life Event Trigger | Based on client milestones (new home, marriage, etc.) | How life changes affect insurance needs, recommended coverage updates |

| Coverage Gap Analysis | Quarterly for single-policy clients | Potential risks not covered by current policies, affordable solutions |

| Bundle Discount Offer | Annually for single-policy holders | Savings calculation with multiple policies, simplified management benefits |

#5) Seasonal and Special Occasion Emails

Source: ReallyGoodEmails (https://files.reallygoodemails.com/emails/protect-your-trip-with-travel-insurance.png)

Timely, non-sales communications build relationships and keep your agency top-of-mind.

| Content | |

|---|---|

| Holiday Greetings | Warm wishes, office closure information, emergency contact details |

| Seasonal Safety Tips | Season-specific risk prevention (winter driving, summer fire safety, etc.) |

| Client Anniversary | Appreciation message, loyalty rewards or referral request |

| Birthday Messages | Personal greeting, no heavy sales pitch |

P.S. Our time zone sending feature ensures these special occasion emails arrive at the appropriate time, regardless of where clients are located.

Read Next:

Key Metrics to Track for Insurance Email Marketing Campaigns

To maximize the effectiveness of your insurance email marketing efforts, monitor these critical metrics:

| Metric | Improvement Strategies |

|---|---|

| Open rate | A/B test subject lines to create urgency or offer personalized deals to boost open rates. Segment your audience to send more targeted, relevant emails. |

| Click-through rate | Optimize your email content by ensuring CTAs are clear, direct, and compelling. Test different CTAs to determine which ones drive the highest engagement. |

| Conversion rate | Simplify the conversion process by including clear “Get a Quote” buttons or direct links to purchase or renew policies in your emails. |

| List growth rate | Use lead magnets, such as free insurance guides, or offer exclusive discounts to encourage sign-ups. Encourage subscribers to share your emails to help expand your list. |

| Unsubscribe rate | If unsubscribe rates rise, evaluate your email frequency and content. Consider offering a preference center where subscribers can choose the types and frequency of emails they receive. |

| Bounce rate | Regularly clean your email list by removing inactive subscribers. Ensure your emails are optimized for mobile and other devices to improve deliverability and reduce bounces. |

With Campaign Monitor’s analytics dashboard, tracking your campaign performance is a breeze. You can monitor live results in real time. Plus, with our detailed engagement reports, you’ll gain insights into open rates, clicks, bounces, shares, and unsubscribes—helping you identify which campaigns are driving the most sales!

Campaign Monitor Makes Insurance Email Marketing Easy & Effective!

Now that you understand the insurance email marketing strategies that help bring in more business, it’s time to implement them with the right tools.

Key takeaways:

- Segment your target audience to deliver hyper-relevant insurance messages

- Personalize communication with policy-specific details and recommendations

- Create mobile-responsive emails that look great on any device

- Maintain list hygiene by removing inactive subscribers

- Stay compliant with insurance regulations and email laws

- Provide valuable content that educates and builds trust

- Craft effective subject lines that boost open rates

Campaign Monitor offers an intuitive platform with powerful segmentation, personalization, and automation features specifically designed to implement these strategies. Our drag-and-drop email builder and template library make it easy to create professional insurance emails quickly, while our robust analytics help you measure and improve results.

P.S. We’ve helped thousands of businesses (regardless of their size) transform their email marketing strategy from generic newsletters to conversion-focused campaigns. If you want to skip the guesswork and start sending emails that actually convert prospects into policyholders, Campaign Monitor has everything you need!

Instant branded emails

With our template builder, you can make branded emails and then send them. It’s that easy.

Learn More

Case Study

Discover how this media brand grew their email list from 30k to 100k in less than a year.

Learn how

The email platform for agencies

We started out helping agencies with email, so let us help you.